Ebitda margin calculation

Is 30 for the year. The EBITDA to sales ratio is a financial metric used to assess a companys profitability by comparing its revenue with earnings.

Ebitda Margin Formula And Calculator Excel Template

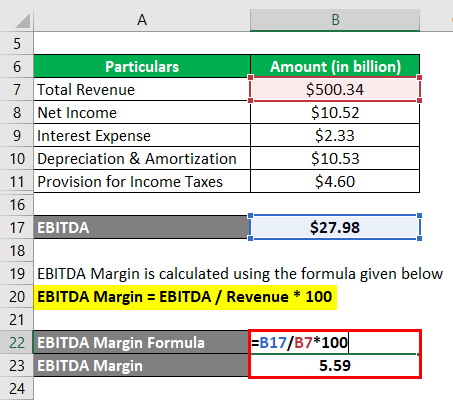

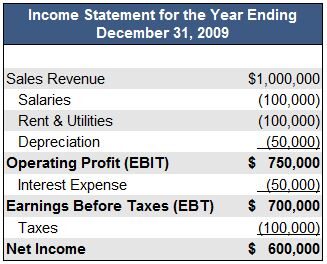

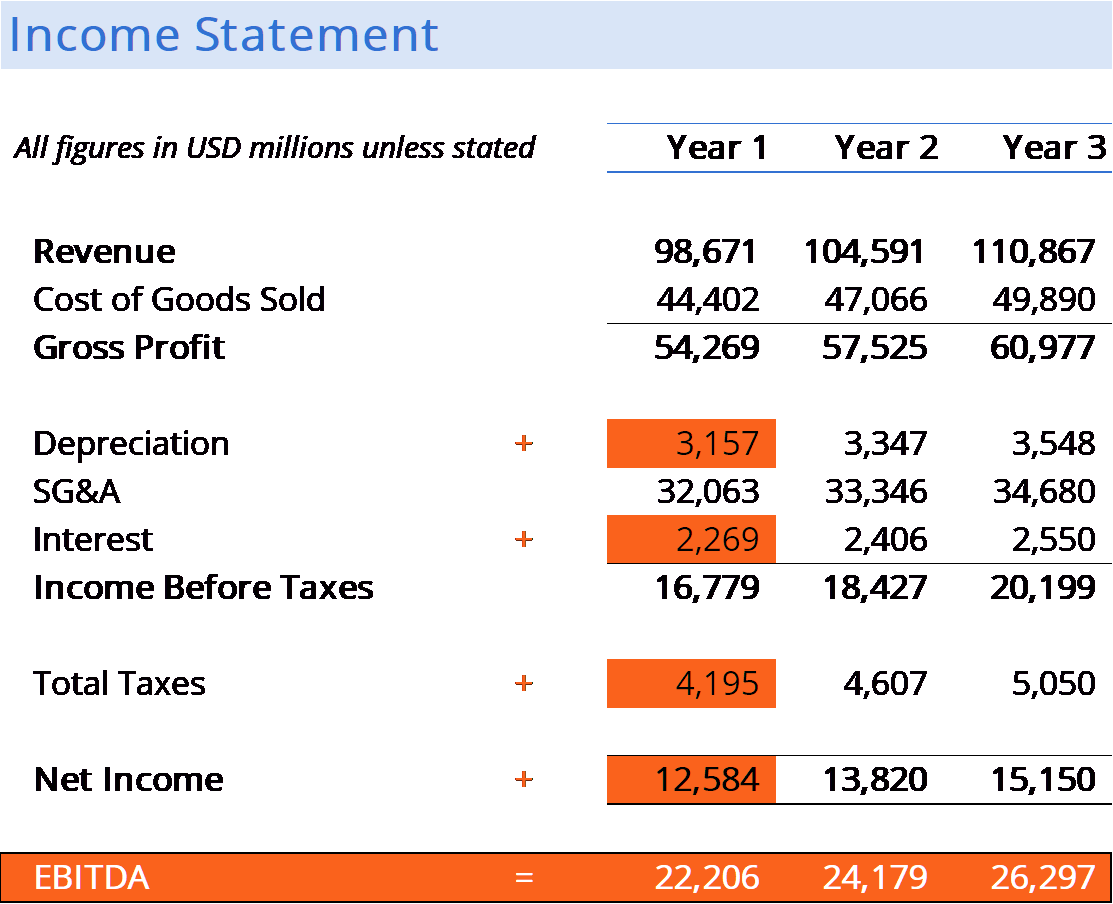

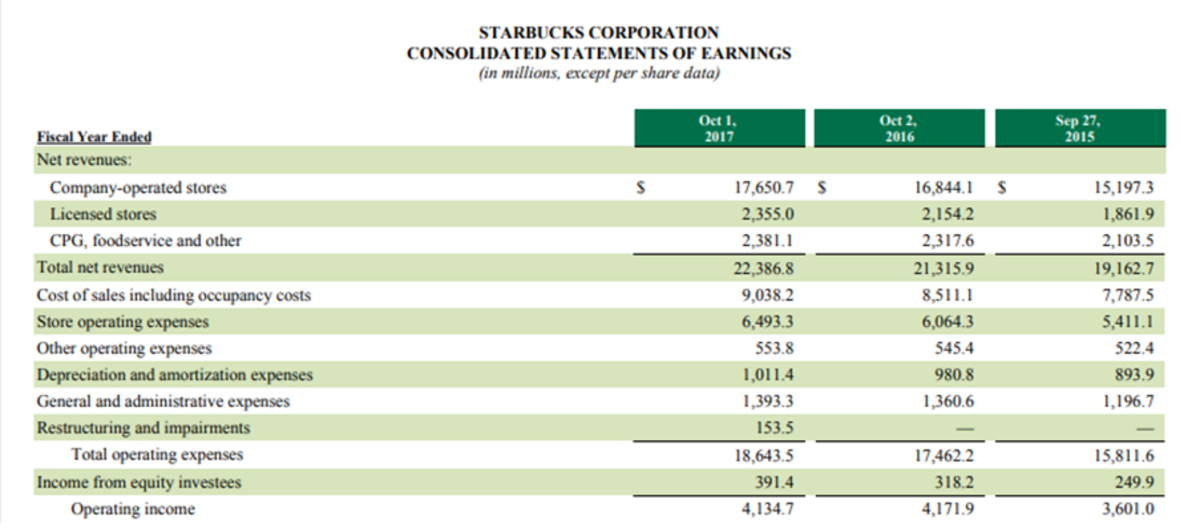

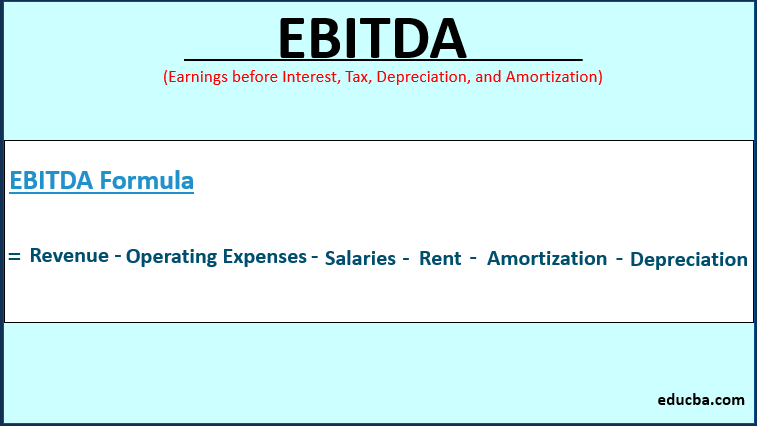

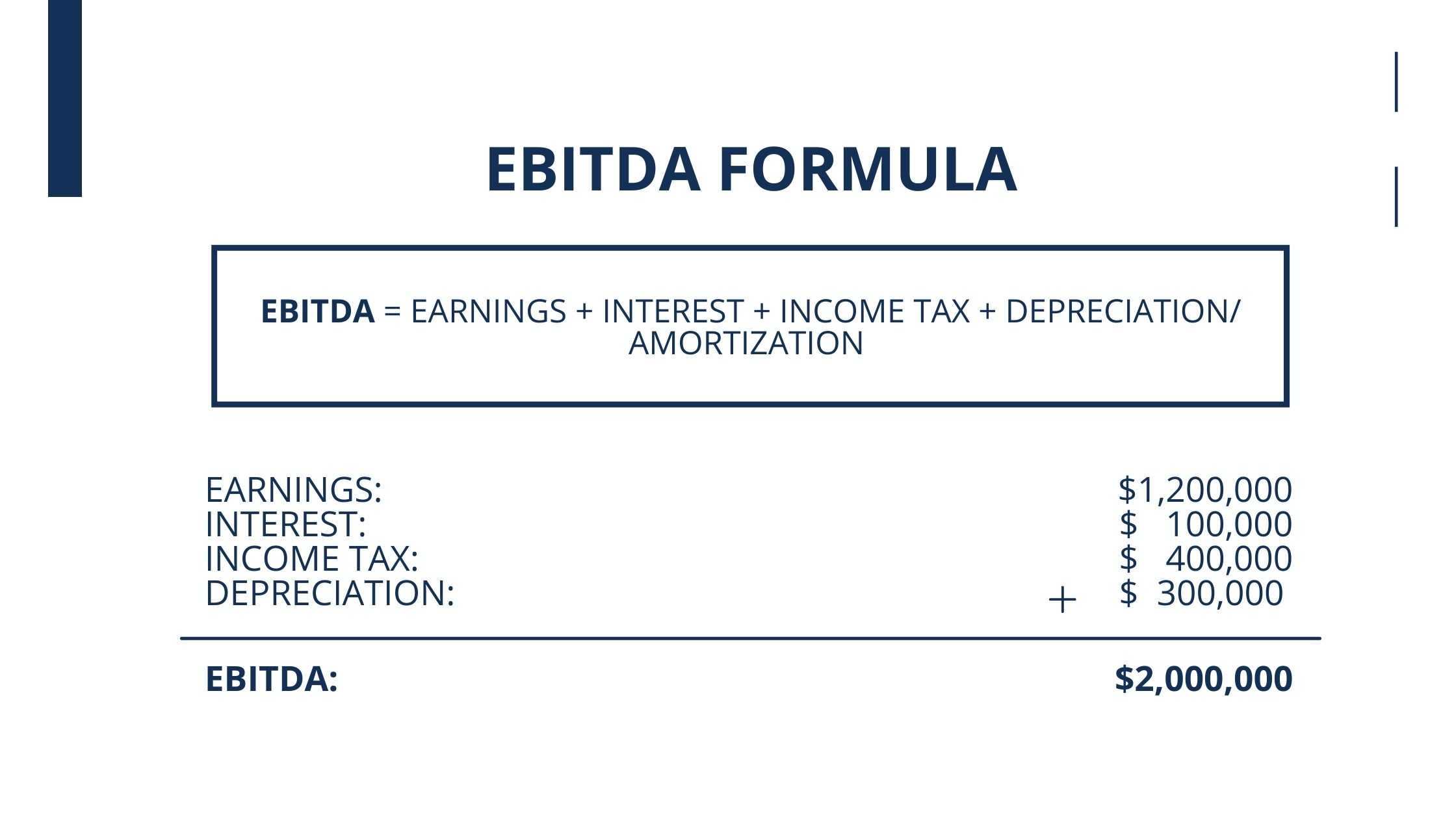

Because there were no earnings in the tax interest and depreciation items these factors must be added in full for the EBITDA calculation.

. Calculation of the formula. The higher the EBITDA margin the less of a risk for an investor. The total EBITDA margin will be around 10.

It represents the relationship between EBITDA and sales. Gross Margin of Colgate. The company itself might have some investments and must be earning interest on those investments.

Second quarter adjusted earnings before interest taxes depreciation and amortization EBITDA of 1211 million was up 29 year over year with adjusted EBITDA margin of 288. As another example if you sold a product for 200 which cost you 160 to buy or manufacture your gross margin would be 20. 76000 100000 76 this calculation is purely demonstrational and not realistic of the market.

Financial ratios are usually split into seven main categories. By contrast to the more widely available PE ratio price-earnings ratio it includes debt as part of the value of the company in the numerator and excludes costs such as the need to replace depreciating plant. The EBITDA margin can ultimately also be calculated from EBITDA.

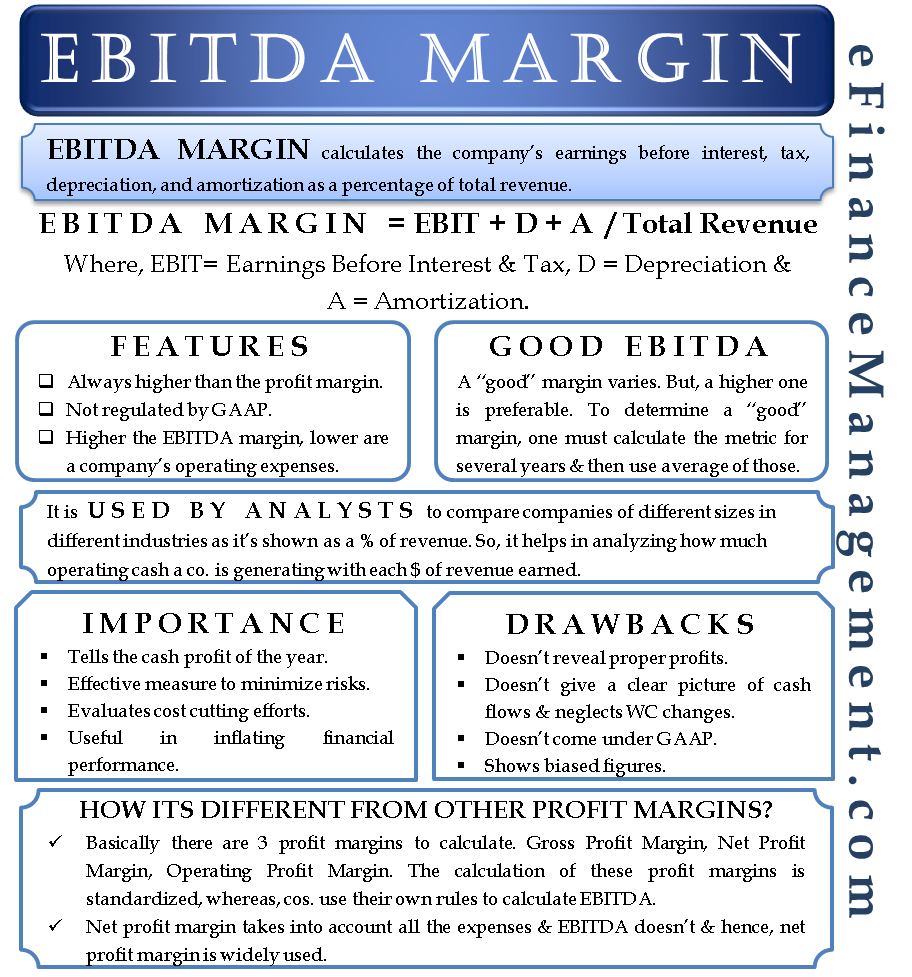

To interpret this percentage we need to look at other similar companies in the same industry. EBITDA margin is a measurement of a companys operating profitability as a percentage of its total revenue. Its a profit margin that shows the operating profit as a percentage of total revenue.

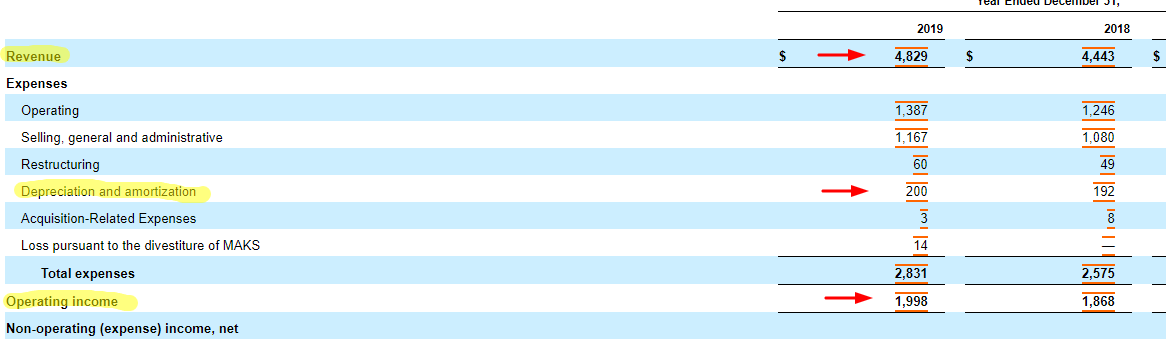

Therefore Bombardier Incs made EBITDA of 1388 million during the year. EBITDA 1388 million. EBITDA total revenue.

As a result EBITDA increased by 383 to RUB 801 billion with a 70 margin which remained flat on a y-o-y basis. Let us calculate Colgates gross margin. The formula for an EBITDA margin is as follows.

Liquidity solvency efficiency profitability equity market prospects investment leverage and coverage. Operating Activities includes cash received from Sales cash expenses paid. Finally an extraordinary return is deducted for the cleaned EBITDA which has a.

Financial ratio analysis compares relationships between financial statement accounts to identify the strengths and weaknesses of a company. Enterprise valueEBITDA more commonly referred to by the acronym EVEBITDA is a popular valuation multiple used to determine the fair market value of a company. EBITDA is an important valuation tool because it is used as a proxy for operating cash flows Operating Cash Flows Cash flow from Operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating business in an accounting year.

The First step in calculating the net interest margin equation is to sum up the investment returns also known as interest income. Gross Margin Selling Price less Cost Price divided by Selling Price multiplied by 100. 200 160 200 x 100 20.

More specifically since EBITDA is derived. By determining a percentage of EBITDA against your companys overall revenue this margin gives an indication of how much cash profit a business makes in a single year. If your business has a larger margin than another it is likely a professional buyer.

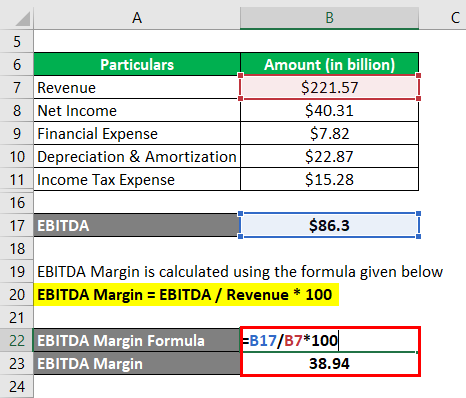

Heres the filled in gross margin equation of that last example. To calculate the EBITDA margin. This was driven by gross margin dynamics and strict cost control offset by other.

EBITDA to sales ratio. EBITDA total revenue EBITDA margin For example lets say Company A has an EBITDA of 500000 along with a total revenue of 5 million. Third Quarter 2022 Guidance.

From the above calculation for the gross margin we can say that the gross margin of Honey Chocolate Ltd. The Company is guiding for third quarter adjusted EBITDA in a range of 0 million - 43 million or a 0 - 35 adjusted EBITDA margin. Using the example above.

EBITDA margin EBITDA Total Revenue. It is equal to earnings before interest tax depreciation and amortization EBITDA. Gross Margin Gross Profit Revenue 100.

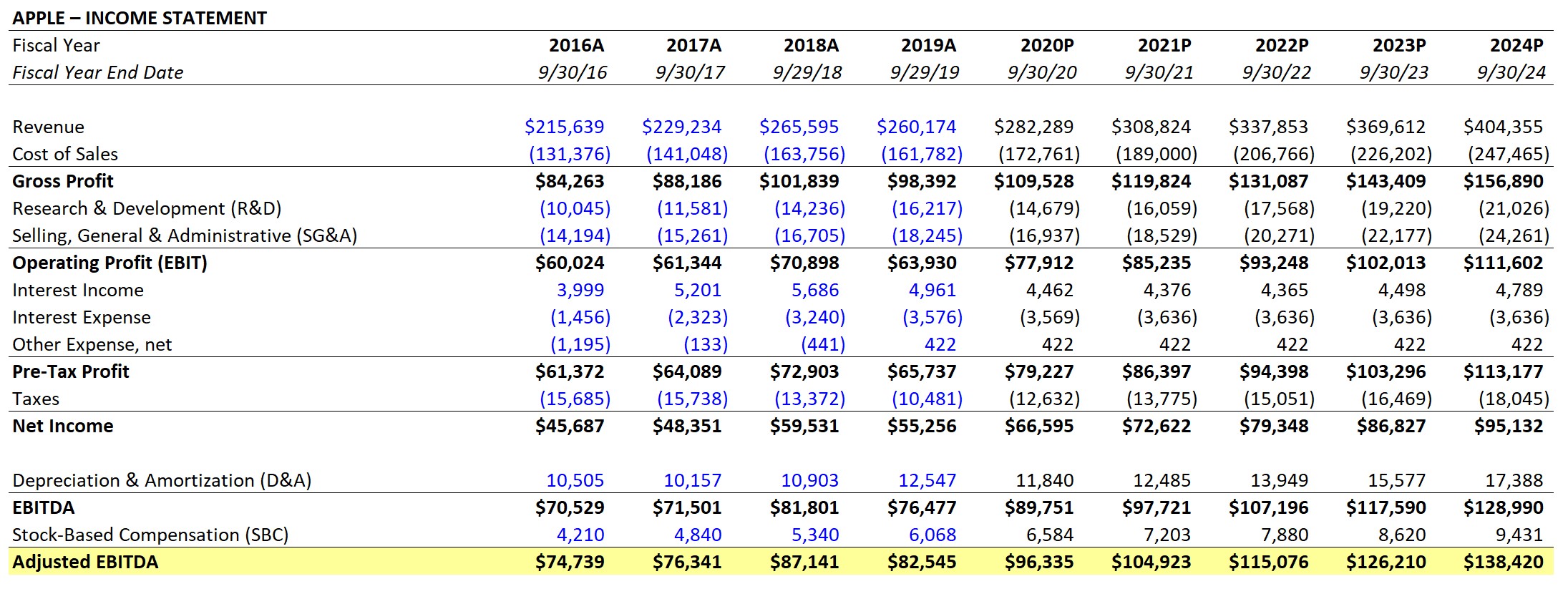

Let us take another real-life example of Apple Inc. Based on the latest annual report for the year ending on September 29 2018 the information is available. EBITDA 318 721 77 272.

EBITDA Formula Example 3. Net Interest Margin Investment Income Interest Expenses Average Earning Assets.

Your Ebitda Margin Guide How To Use The Controversy Real Examples

Ebitda Margin Template Download Free Excel Template

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Definition Example Investinganswers

How Do I Calculate An Ebitda Margin Using Excel

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula Meaning Interpretation With Examples

Ebitda Margin Features Importance Drawbacks Other Profit Margins

What Is Ebitda Formula Example Margin Calculation Explanation

What Is Ebitda Formula Definition And Explanation

How To Calculate Ebitda Margin

What Is Ebitda Formula Example Margin Calculation Explanation

What Is An Ebitda Margin Examples And How To Calculate Thestreet

Ebitda Types And Components Examples And Advantages Of Ebitda

Ebitda Margin Formula And Calculator Excel Template

Ebitda Margins What Every Small Company Owner Needs To Know

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin